Texas LLC Benefits: Why Texas Is One of the Best States to Form an LLC

Texas LLC Benefits: Why Texas Is One of the Best States to Form an LLC

Texas is consistently ranked as one of the most business-friendly states in the U.S. Thanks to favorable tax laws, strong asset protection, and a pro-business regulatory environment, forming a Texas LLC is an attractive option for entrepreneurs, freelancers, real estate investors, and growing companies.

This guide breaks down the key benefits of forming an LLC in Texas, who benefits the most, and when a Texas LLC makes the most sense.

Why So Many Businesses Choose Texas for an LLC

Texas offers a unique combination of:

✔ No personal income tax

✔ No corporate income tax

✔ Strong liability and asset protection

✔ Flexible LLC laws

✔ A massive and diverse economy

✔ Business-friendly regulations

These advantages make Texas one of the top states for LLC formation—especially for owners who live or operate in Texas.

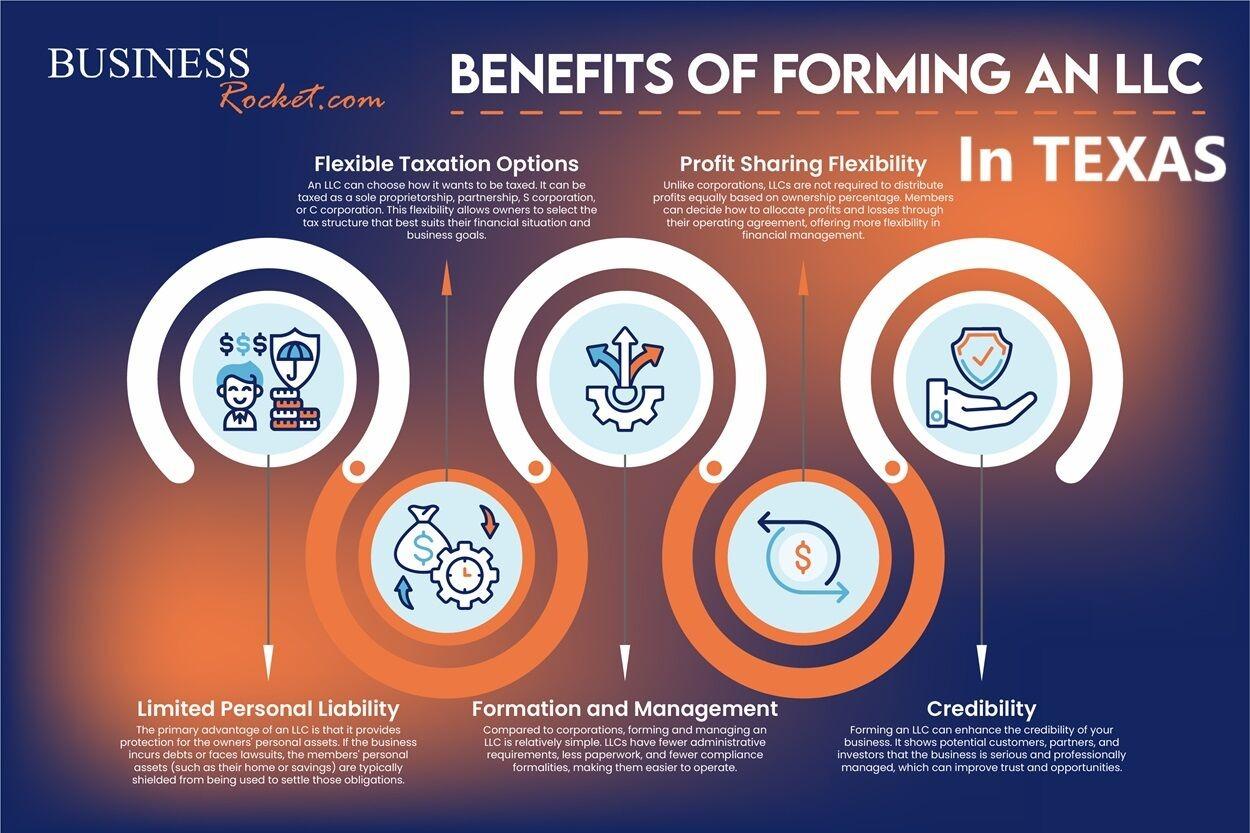

Top Benefits of a Texas LLC

1. No Personal State Income Tax

One of the biggest advantages of a Texas LLC is:

✅ Texas has NO personal income tax

This means:

-

LLC profits passed through to owners are not taxed at the state level

-

Members only pay federal income tax

-

Higher take-home income for owners

Compared to states like California or New York, this can save thousands of dollars each year.

2. No Corporate Income Tax

Texas also does not impose a traditional corporate income tax.

Instead, Texas uses a franchise tax, which:

-

Applies only if revenue exceeds a threshold

-

Is often $0 for small businesses

-

Is simpler than corporate income tax

Many Texas LLCs pay no state-level business tax at all.

3. Texas Franchise Tax Is Often $0

Texas LLCs must file a franchise tax report, but:

✔ If total revenue is below the no-tax-due threshold, no tax is owed

✔ The threshold adjusts annually (often over $2 million)

✔ Filing is still required—but payment is often zero

This makes Texas extremely attractive for startups and small businesses.

4. Strong Liability Protection for Owners

A Texas LLC provides:

✔ Protection of personal assets from business debts

✔ Shield against most lawsuits tied to the business

✔ Clear separation between owner and company

Texas courts strongly respect LLC liability protections when formalities are followed.

5. Excellent Asset Protection Laws

Texas is famous for its asset protection.

Key advantages include:

-

Strong homestead protections

-

Favorable charging-order protections for LLC members

-

Limits on creditor access to LLC interests

For real estate investors, consultants, and high-income professionals, this is a major benefit.

6. Flexible Management Structure

Texas LLCs allow you to choose how your company is run:

✔ Member-managed LLC

Owners handle daily operations.

✔ Manager-managed LLC

Managers run operations while members remain passive.

This flexibility is ideal for:

-

Solo owners

-

Partnerships

-

Investor-backed companies

-

Family businesses

7. Simple and Fast LLC Formation

Forming an LLC in Texas is straightforward.

Texas LLC basics:

-

Filing fee: $300

-

Online filing available

-

Processing time: often 1–3 business days

-

No publication requirement

Texas also offers expedited processing if needed.

8. Strong Business Credibility

A Texas LLC carries strong credibility due to:

✔ Texas’s large economy

✔ Business-friendly reputation

✔ Recognition by banks, vendors, and investors

For many industries—especially energy, construction, real estate, logistics, and tech—a Texas LLC adds legitimacy.

9. Ideal for Real Estate Investors

Texas LLCs are especially popular for real estate.

Benefits include:

-

Asset protection

-

Favorable landlord laws

-

Strong charging-order protection

-

No state income tax on rental profits

Many investors use multiple Texas LLCs to isolate properties.

10. Texas Is One of the Largest Business Economies

Texas has:

-

The 2nd largest state economy in the U.S.

-

Major metro hubs (Austin, Dallas, Houston, San Antonio)

-

No shortage of customers, talent, or infrastructure

Operating in Texas gives businesses access to a massive market.

Texas LLC vs. Other States (Quick Comparison)

| Feature | Texas | California | Delaware |

|---|---|---|---|

| Personal Income Tax | ❌ No | ✅ Yes | ✅ Yes |

| Corporate Income Tax | ❌ No | ✅ Yes | ❌ No |

| Annual Minimum Tax | Often $0 | $800 | $300 |

| Formation Cost | $300 | $0 (but high annual tax) | $90 |

| Best For | Local & growing businesses | Large CA-based businesses | VC-backed startups |

Who Should Form a Texas LLC?

A Texas LLC is ideal if:

✔ You live in Texas

✔ You operate primarily in Texas

✔ You want low ongoing taxes

✔ You want strong asset protection

✔ You run a service business, agency, or consultancy

✔ You invest in Texas real estate

✔ You want simple compliance

For most Texas-based business owners, forming in Texas is the best option.

When a Texas LLC May NOT Be the Best Choice

Texas may not be ideal if:

❌ You live and operate entirely in another state

❌ You plan to raise venture capital immediately (Delaware preferred)

❌ Your business is headquartered elsewhere

❌ You want maximum anonymity (Wyoming or New Mexico may be better)

Forming out-of-state often leads to foreign LLC registration costs.

Texas LLC Tax Flexibility

A Texas LLC can choose how it’s taxed:

✔ Sole proprietorship (single-member)

✔ Partnership (multi-member)

✔ S-Corporation election (popular for tax savings)

✔ C-Corporation election (less common)

Texas does not restrict your federal tax options.

Common Myths About Texas LLCs

❌ “Texas LLCs pay no taxes at all” → Not always, but often low

❌ “Anyone should form in Texas” → Only if you operate there

❌ “Texas LLCs avoid all franchise tax” → Filing is required

❌ “Texas is only good for big businesses” → Small businesses benefit most

How Much Does a Texas LLC Cost Annually?

Typical annual costs:

-

Franchise tax filing: $0–$1,000+ (often $0)

-

Registered agent (optional): $100–$300

-

Accounting/compliance: varies

Many small Texas LLCs operate for under $300/year.

Final Thoughts: Texas LLC Benefits

Top Reasons to Form a Texas LLC

✔ No personal income tax

✔ No corporate income tax

✔ Often $0 franchise tax

✔ Strong liability protection

✔ Excellent asset protection

✔ Business-friendly environment

✔ Large, diverse economy

For entrepreneurs and business owners who live or operate in Texas, a Texas LLC offers one of the best combinations of tax efficiency, legal protection, and simplicity in the U.S.

Get Free Consultation with FormLLC

Comments

Post a Comment